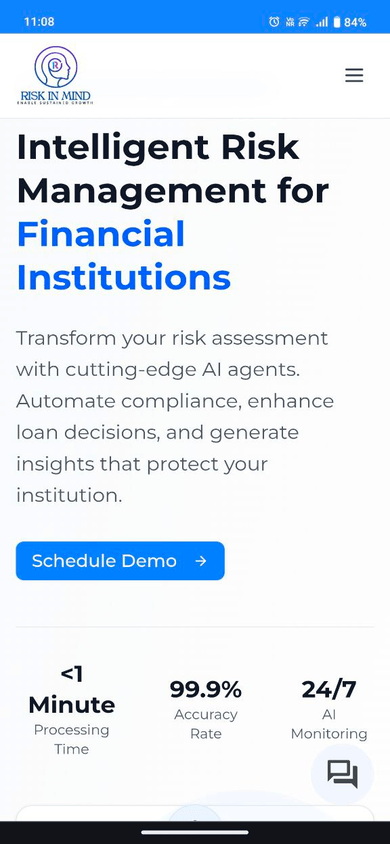

Intelligent Risk Management for Financial Institutions

Transform your risk assessment with cutting-edge AI agents. Automate compliance, enhance loan decisions, and generate insights that protect your institution.

Meet Ava - Your AI Risk Management Director

Ava intelligently routes your requests to specialized AI agents, ensuring you get expert assistance for every aspect of risk management.

Our Specialized AI Agents

Each AI agent is expertly trained in their domain, working together under Ava's coordination to provide comprehensive risk management solutions.

- Real-time regulation tracking

- Automated compliance reports

- Risk scoring algorithms

- ML-powered credit scoring

- Alternative data integration

- Automated underwriting

- Market trend analysis

- Portfolio optimization

- Predictive modeling

- Automated report generation

- Template customization

- Regulatory compliance

Cutting-Edge AI Technology

Our platform leverages the latest advances in artificial intelligence, including large language models, machine learning, and neural networks to deliver unparalleled accuracy and insights.

Neural Networks

Advanced deep learning models trained on vast financial datasets for superior pattern recognition.

Real-Time Processing

Lightning-fast analysis and decision-making with sub-second response times for critical operations.

Enterprise Security

Bank-grade security with end-to-end encryption and compliance with financial industry standards.

AI Model Performance

See Our Platform in Action

Watch our comprehensive demos to understand how our AI-powered platform can transform your risk management processes.

Platform Overview Demo

Complete walkthrough of our AI risk management platform

Portfolio Manager Demo

Deep dive into our Portfolio Manager and capabilities

Trusted by Leading Financial Institutions

Join hundreds of banks, credit unions, and lenders leveraging our SOC 2® report platform for secure, compliant AI risk management.

99.9% Uptime

Enterprise-grade reliability with redundant systems and continuous monitoring.

Bank-Grade Security

End-to-end encryption for all data in transit and at rest, compliant with financial regulations.

Manage Risk on the Go with our Mobile App

Stay connected to your risk dashboard anywhere, anytime. Get instant alerts, review loan applications, and communicate with your AI agents directly from your mobile device.

Trusted by Our Clients

Here's what financial professionals are saying about RiskInMind

"RiskInMind has completely transformed our loan assessment process. The AI agents are incredibly accurate and have saved us countless hours of manual review."

"The regulatory compliance monitoring is a game-changer. We're now alerted to changes instantly and can adapt faster than ever before."

"I was skeptical about AI in risk management, but the results speak for themselves. The depth of analysis provided by the Financial Analyst agent is impressive."

Frequently Asked Questions

Common questions about RiskInMind and our platform

RiskInMind™ is an AI-powered risk management platform that helps financial institutions streamline loan applications across consumer, commercial, and commercial real estate products while enhancing portfolio oversight and regulatory workflows. It centralizes risk data and analytics so loan, portfolio, and regulatory teams can assess, monitor, and document risk more consistently, enabling faster and more informed decisions across the credit lifecycle.

RiskInMind™ is designed for risk managers, portfolio managers, and regulatory risk managers at credit unions, community and regional banks, and other financial institutions that underwrite loans, monitor credit risk, reserve for losses under CECL, and oversee portfolio performance. It supports organizations operating under regulatory frameworks and oversight from bodies such as the NCUA, OCC, and FRB, delivering scalable, data-driven tools for risk assessment, portfolio management, and compliance obligations.

RiskInMind™ replaces manual, fragmented processes with AI-driven automation that accelerates lending, lowers risk, and ensures compliance while improving oversight across the institution. It streamlines loan underwriting, regulatory reporting, and portfolio monitoring—turning decisions that once took days into minutes—so teams can catch emerging risks earlier, reduce errors, and protect both assets and member trust.